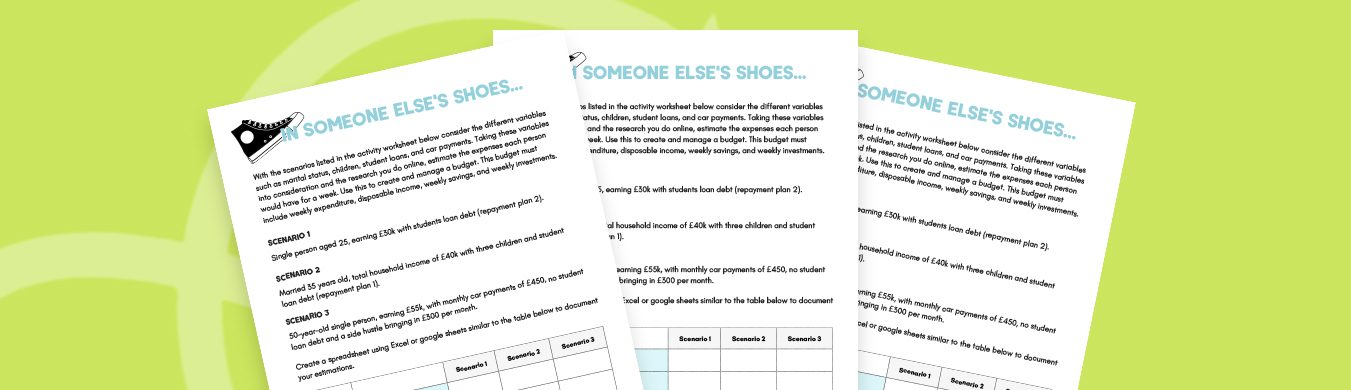

Ever wondered what it’s really like to manage money as an adult? This activity puts you in someone else’s shoes — literally. Through real-life financial scenarios, you’ll explore what it means to balance income, expenses, savings, and debt at different life stages.

Each scenario challenges you to think about how factors like family size, student loans, or car payments affect budgeting and decision-making. Using your research and the activity worksheet, you’ll estimate weekly spending, disposable income, and savings to create a realistic personal budget.

💡 What you’ll learn:

- How to research and calculate everyday expenses and financial commitments

- How different lifestyles and responsibilities impact money management

- How to build a weekly budget that includes spending, savings, and investments

- The basics of financial planning using tools like Excel or Google Sheets

🧾 What to do:

Step into each scenario, make your estimates, and build a spreadsheet that tracks income and outgoings. Adjust your figures to see how small changes affect financial outcomes — and reflect on what this means for real-world decision-making.

🎯 Takeaway:

You’ll finish with a hands-on understanding of budgeting, financial trade-offs, and money management — plus a clearer picture of what financial independence really looks like.

Download our guide now and step into the shoes of adulthood to improve your financial literacy.

RECOMMENDED RESOURCES