I particularly love today’s post because many of the principles we learnt about in this session were extremely simple. More importantly, a lot of them transcend our attitude to money. These are things which can have a material impact on our lives beyond just our financial habits: contentment, discipline, gratitude and intentionality. Often, financial wellness is played up to be a very complex and all encompassing thing. I’m not disputing that it can be but sometimes, go back to the basics and things become a lot clearer.

In today’s post, you’ll learn:

- The meaning of money (and what money isn’t)

- The characteristics of a bad money mindset and the consequences

- The characteristics of a good money mindset and its consequences

- Practical steps to improve your financial habits.

Firstly, I’d like you to pause reading and take this money personality quiz– when trying to improve, it’s important to know exactly what you want to work on. The Barclays Life Skills test will help you identify which areas out of Money morals, Spending vs. saving, Money management and Getting money you should work on the most. Once you’ve identified what to work on, note them down as we go through today’s tips.

What is money?

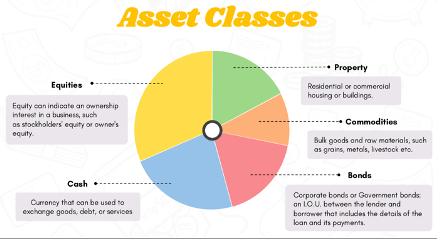

Simply put, money is a store of value (like an asset, commodity or currency) and a means of exchanging value- an instrument used to obtain something of value to you. Contrary to what is often portrayed, it’s not a measure of your value or importance nor is it the most important thing in life but it’s essential to recognise it as a medium for exchanging value. (I like to think of it as a means to an end, not an end in itself. Exactly what that end is, is up to you to define) This also means that to earn money, you have to provide value in some way and when you spend money, you’re exchanging it for something you value.

What does a bad money mindset look like?

- Instant gratification- Always fulfilling the need to be satisfied instantly means that we don’t always think through our decisions or end up making decisions that don’t benefit us in the long-term.

- Peer pressure- #keeping up with the joneses has many young people broke and the danger is that it keeps you chasing a lifestyle you can’t afford. Perhaps more annoyingly, the goalpost is constantly evolving; what you thought was socially valuable today could be expired tomorrow so start defining what is valuable by yourself as opposed to constantly following the trends.

- Scarcity- The aim is to move from having a scarcity mindset to developing an abundance mindset and if you’re wondering what this means then have a look at this blog post!

- Greed- Given that you can never reach a ‘maximum’ amount of money, chasing money can be chasing something without end- that’s bound to be exhausting.

- Lack of intentionality- Know what something ‘valuable’ constitutes to you and aim to invest in these things.

- Lack of education- Ignorance in the area of financial literacy is indeed not bliss so I would definitely advise any young person reading this to start learning as much as you can on this topic and of course, we have lots of resources on this topic if you’re looking for a place to start!

Maintaining a bad money mindset can lead to other difficulties including dissatisfaction, not being able to retire when you would like to or even stress which can affect our mental health. As I mentioned earlier, some of the points listed above aren’t things to only avoid when it comes to our finances- greed is hardly ever a helpful trait. So, let’s turn to looking at the markers of a good money mindset and how we can develop one.

What does a good money mindset look like and how do I develop one?

- Delayed gratification- This doesn’t mean that you never get the gratification, it’s just delayed to a time when you can afford to buy the new shoes for example.

- Be Intentional- Make a spending plan, a saving plan and know where and how you would like to manage, spend and invest your money.

- Seek education and learn more about money management whether that’s through reading, listening to podcasts or even speaking to your local bank. Our SMART Money Goals 2021 YouTube Series will be launching soon so be sure to follow our channel to see the videos once they’re released!

- Build good habits- start small, keep going, reward yourself and review your progress regularly.

- Contentment and gratitude. This is so, so key as it’s important to be able to recognise what you have and not just what you don’t have. As mentioned in this session, a lot of money does NOT necessarily equal good money mindset or a good attitude to money so be sure to practice being grateful for what you have.

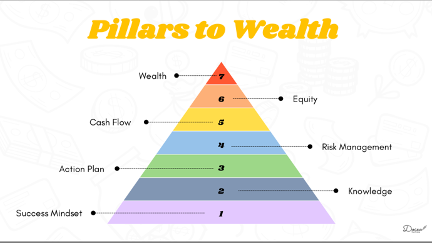

Session 2: Pillars to Wealth

As the diagrams below show, building wealth really is a process so remember that it’s one step at a time!

As a starting point, here’s an exciting challenge for you: find 1p and save that. Increase the amount you save each day by adding 1p to the previous day’s. On day 1, you’ll save 1p, 2p on day 2 and 3p on day 3 and in a year, you’ll have at least £700 saved!

I hope this post has been helpful because we really do want you to be securing the bag and remember that if you’d like to learn more, our SMART Money Goals 2021 YouTube Series will be out soon so follow our channel to know once these videos are out!